E-commerce Industry in India

Indian e-commerce is expected to grow at a compound annual growth rate (CAGR) of 27% to reach US$ 163 billion by 2026.

Advantage India

Growing

Demand

* The Indian e-commerce industry is projected to reach US$ 300 billion by 2030, experiencing significant growth.

* Third-party logistics providers are anticipated to manage approximately 17 billion shipments within the next seven years.

* India has around 936.16 million internet subscribers, including about 350 million mature online users actively engaging in transactions.

Attractive

Opportunities

* India's e-commerce platforms achieved a significant milestone, hitting a GMV of US$ 60 billion in fiscal year 2023, marking a 22% increase from the previous year.

* The Government e-Marketplace (GeM) platform's Gross Merchandise Value (GMV) doubled in FY24 to cross the Rs. 4 Lakh Crore(US$ 47.96 billion) mark, driven by a 205% surge in the procurement of services, which accounted for nearly 50% of the total GMV.

Policy

support

* 100% FDI is allowed in B2B e-commerce.

* 100% FDI under the automatic route is permitted in the marketplace model of E-commerce.

Increasing

Investments

* The indigenous e-commerce giant Flipkart is poised to raise US$ 1 billion in a new funding round, with its parent company Walmart anticipated to contribute US$ 600 million.

* Google LLC is investing US$ 350 million in Flipkart as part of a nearly US$ 1 billion funding round led by Walmart Inc., Flipkart's majority stakeholder, with the investment aimed at expanding Flipkart's business and modernizing its digital infrastructure to serve customers across India, and the two companies also plan to increase Flipkart's use of Google's cloud platform.

* In October 2023, Tata Group announced a US$ 1 billion investment in its super app, Tata Neu, in addition to the US$ 2 billion previously invested in its digital division earlier that year.

Snapshot Showcase Infographics Reports Related News

Last updated: Jul, 2024

E-Commerce Industry Report

Introduction

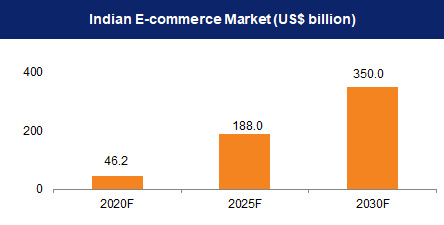

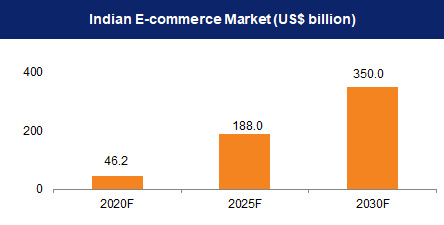

In recent years India has experienced a boom in internet and smartphone penetration. As of June 2023, the number of internet connections in India significantly increased to 895 million, driven by the ‘Digital India’ program. Out of the total internet connections, ~55% of connections were in urban areas, of which 97% of connections were wireless. The smartphone base has also increased significantly and is expected to reach 1.1 billion by 2025. This has helped India’s digital sector, and it is expected to reach US$ 1 trillion by 2030. This rapid rise in internet users and smartphone penetration coupled with rising incomes has assisted the growth of India’s e-commerce sector. India’s e-commerce sector has transformed the way business is done in India and has opened various segments of commerce ranging from business-to-business (B2B), direct-to-consumer (D2C), consumer-to-consumer (C2C) and consumer-to-business (C2B). Major segments such as D2C and B2B have experienced immense growth in recent years. India’s D2C market is expected to reach US$ 60 billion by FY27. The overall e-commerce market is also expected to reach US$ 350 billion by 2030 and will experience 21.5% growth in 2022 and reach US$ 74.8 billion.

Market Size

The Indian online grocery market is estimated to reach US$ 26.93 billion in 2027 from US$ 3.95 billion in FY21, expanding at a CAGR of 33%. India's consumer digital economy is expected to become a US$ 1 trillion market by 2030, growing from US$ 537.5 billion in 2020, driven by the strong adoption of online services such as e-commerce and edtech in the country.

The Indian e-commerce industry is projected to reach US$ 300 billion by 2030, experiencing significant growth. Third-party logistics providers are anticipated to manage approximately 17 billion shipments within the next seven years.

The e-retail market in India is projected to surpass US$ 160 billion by 2028. In 2023, the market is estimated to be valued between US$ 57-60 billion, marking a significant increase from previous years. This growth equates to an annual addition of US$ 8-12 billion since 2020.

The India Quick E-Commerce (Quick Commerce) market is poised for exponential growth, projected to reach US$ 19,932.5 million driven by rising internet and smartphone penetration, convenience of quick delivery, and accelerated adoption during COVID-19, with diverse product categories and order value segments catering to evolving consumer preferences, and the domination of metropolitan cities presenting significant opportunities for retailers and key players to capitalize on the rapidly expanding market.

In FY23, the Gross Merchandise Value (GMV) of e-commerce reached US$ 60 billion, increasing 22% over the previous year. In FY22, the GMV of e-commerce stood at US$ 49 billion.

India's Business-to-Business (B2B) online marketplace would be a US$ 200 billion opportunity by 2030.

With over 821 million users, India was the second-largest internet market in the world with 117.6 billion UPI transactions in 2023.

According to a Deloitte India Report, as India is moving towards becoming the third-largest consumer market, the country's online retail market size is expected to reach US$ 325 billion by 2030, up from US$ 70 billion in 2022, largely due to the rapid expansion of e-commerce in tier-2 and tier-3 cities.

The e-commerce industry in India demonstrated remarkable resilience and diversification in fiscal year 2023 (FY23), recording a robust 26.2% jump in order volumes. This growth was primarily driven by a 31.1% surge in demand from tier-1 cities, as work-from-office arrangements resumed following the pandemic-induced disruptions.

The e-commerce market’s share of Tier-3 cities grew from 34.2% in 2021 to 41.5% in 2022, shows data.

The B2C E-commerce is expected to grow steadily over the forecast period, recording a CAGR of 8.68% during 2023-27. According to a recent report by RedSeer, India’s e-B2B market is projected to reach a GMV of US$ 100 billion by 2030.

According to Grant Thornton, e-commerce in India is expected to be worth US$ 188 billion by 2025. Propelled by rising smartphone penetration, the launch of the 4G network and increasing consumer wealth, the Indian E-commerce market is expected to grow to US$ 200 billion by 2026 from US$ 38.5 billion in 2017.

After China and the US, India had the third-largest online shopper base of 150 million in FY21 and is expected to be 350 million by FY26.

Indian consumers are increasingly adopting 5G smartphones even before the rollout of the next-gen mobile broadband technology in the country. Smartphone shipments reached 169 million in 2021 with 5G shipments registering a growth of 555% year-on-year over 2020. Indian consumers are increasingly adopting 5G smartphones even before the rollout of the next-gen mobile broadband technology in the country. Smartphone shipments reached 150 million units and 5G smartphone shipments crossed four million in 2020, driven by high consumer demand post-lockdown. According to a report published by IAMAI and Kantar Research, India’s internet users are expected to reach 900 million by 2025 from ~622 million internet users in 2020, increasing at a CAGR of 45% until 2025.

For the first week of 2023 festive season, Indian e-commerce platforms generated sales worth US$ 5.67 billion Gross Merchandise Value (GMV).

Investments/Developments

Some of the major developments in the Indian e-commerce sector are as follows:

- Google LLC is investing US$ 350 million in Flipkart as part of a nearly US$ 1 billion funding round led by Walmart Inc., Flipkart's majority stakeholder, with the investment aimed at expanding Flipkart's business and modernizing its digital infrastructure to serve customers across India, and the two companies also plan to increase Flipkart's use of Google's cloud platform.

- The indigenous e-commerce giant Flipkart is poised to raise US$ 1 billion in a new funding round, with its parent company Walmart anticipated to contribute US$ 600 million.

- On August 25, 2023, Zepto, a two-year-old company, achieved unicorn status by securing US$ 200 million in funding, resulting in a valuation of US$ 1.4 billion, marking India's inaugural unicorn of 2023.

- In October 2023, Tata Group announced a US$ 1 billion investment in its super app, Tata Neu, in addition to the US$ 2 billion previously invested in its digital division earlier that year.

- In 2023, Amazon India achieved significant milestones, including surpassing a seller base of 14 lakh with three lakh new additions, digitizing 6.2 million small businesses, facilitating US$ 8 billion in exports, and generating 1.3 million jobs. Additionally, they committed to further digitizing 10 million businesses, enabling US$ 20 billion in exports, and create two million jobs by 2025, while also signing an MoU with DGFT for MSME capacity-building initiatives.

- On January 17, 2024, Shiprocket and Truecaller collaborated to empower sellers with seamless e-commerce transactions. This strategic partnership aims to streamline mobile onboarding to shopping journeys for three lakh Shiprocket merchants, enhancing the consumer experience.

- On December 4, 2023, ODN partnered with Middle East-based Channel Engine for the GCC e-commerce market, aiming to redefine the landscape by connecting brands and retailers to global sales channels for cross-border success.

- On February 6, 2024, Flipkart inaugurated its fourth grocery fulfilment centre in Malda, West Bengal, fostering over 700 local jobs and facilitating nationwide market access for local sellers, MSMEs, and farmers. The 1.13 lakh square feet center processes over 7,000 orders daily, affirming Flipkart's commitment to prompt delivery and enhancing regional economic prospects.

- In October 2023, a tech-driven logistics platform iThink Logistics announced a strategic collaboration with India Post to boost e-commerce deliveries across remote parts of the country.

- Amazon CEO Mr. Andy Jassy announced that the company is committed to investing US$ 26 billion in India by 2030, out of which US$ 11 billion has already been invested.

- In July 2023, the post office departments of Canada and India recently entered into an agreement, which is aimed at facilitating e-commerce exports and establishing an International Tracked Packet Service (ITPS) between the two countries.

- As of May 2023, the Indian government's open e-commerce network ONDC has expanded its operations into 236 cities in the country while adding more than 36,000 merchants.

- In June 2023, Amazon India launched its new and affordable Amazon Prime Lite membership plan for shoppers in the country.

- Walmart is preparing to spend over US$ 2.5 billion in India as the retailer doubles down on the opportunities it sees in India’s e-commerce and payments markets.

- Hyperlocal e-commerce startup, Magicpin announced that its daily order volume has zoomed 100-fold to 10,000 per day from over 100 within a month of joining the government-promoted Open Network for Digital Commerce (ONDC) network.

- In June 2022, Amazon India signed an MoU with Manipur Handloom & Handicrafts Development Corporation Limited (MHHDCL), a Government of Manipur Enterprise to support the growth of artisans and weavers across the state.

- India’s eCommerce sector received US$ 15 billion of PE/VC investments in 2021 which is 5.4 times increase year on year. This is the highest investment value received by any sector ever in India.

- In February 2022 Xpressbees a logistics ecommerce platform became a unicorn valued at US$ 1.2 billion in 2022. The firm raised US$ 300 million in its Series F funding.

- In February 2022, Amazon India launched the One District One product (ODOP) bazaar on its platform to support MSMEs.

- In February 2022, Flipkart launched the “sell back program” to enable trade in smartphones.

- In January 2022, Walmart invited Indian sellers to join its US marketplace with the aim of exporting US$ 10 billion from India each year by 2027.

- In January 2022, Flipkart has announced expansion in its grocery services and will offer services to 1,800 Indian cities.

- In November 2021, XPDEL US-based ecommerce announced expansion in India.

- In September 2021, CARS24, India's leading used car e-commerce platform, raised US$ 450 million in funding, comprising a US$ 340 million Series F equity round and US$ 110 million in debt from various financial institutions.

- In September 2021, Amazon launched Prime Video Channels in India. Prime Video Channels will give Prime members a seamless experience and access to a variety of popular video streaming services.

- In September 2021, Bikayi, a mobile commerce enabler, raised US$ 10.8 million in a Series A funding round, led by Sequoia Capital India.

- Flipkart, India's e-commerce powerhouse, announced in July 2021 that it has raised US$ 3.6 billion in new funding from various sources including sovereign funds, private equities, and Walmart (parent company).

Government Initiatives

Since 2014, the Government of India has announced various initiatives, namely Digital India, Make in India, Start-up India, Skill India, and Innovation Fund. The timely and effective implementation of such programs will likely support the growth of E-commerce in the country. Some of the major initiatives taken by the Government to promote E-commerce in India are as follows:

- The Government e-Marketplace (GeM) platform's Gross Merchandise Value (GMV) doubled in FY24 to cross the Rs. 4 Lakh Crore(US$ 47.96 billion) mark, driven by a 205% surge in the procurement of services, which accounted for nearly 50% of the total GMV.

- As of March 2024, the GeM portal served 5.8 million orders worth Rs. 3,87,006 crore (US$ 46.67 billion) with 148,245 primary buyers and 215,743 secondary buyers.

- On February 4, 2024, CSC and ONDC partnered to expand e-commerce reach to rural areas in India. This collaboration integrates CSC's e-Grameen app with the ONDC network, providing citizens across rural India access to a vast e-commerce network, fostering entrepreneurship opportunities and driving the vision of Gram Swaraj.

- On February 14, 2024, the Ministry of Defence (MoD) announced that procurement through the Government e-Market (GeM) portal has exceeded Rs. 1 lakh crore (US$ 12.06 billion), with nearly half of the transactions occurring in the current fiscal year. GeM, launched in 2016, facilitates online purchases for central government ministries. MoD has executed over 5.47 lakh orders, with approximately Rs. 45,800 crore (US$ 5.52 billion) awarded this fiscal year. Notably, 50.7% of orders, totalling Rs. 60,593 crore (US$ 7.31 billion) have been awarded to Micro and Small Enterprises (MSEs). GeM has emerged as a pivotal platform for optimizing public spending in the Defence sector, with the Ministry showcasing a resolute commitment towards efficient procurement practices.

- Government e-Marketplace (GeM) is an online platform for public procurement in India that was launched on August 9, 2016, by the Ministry of Commerce and Industry with the objective of creating an inclusive, efficient, and transparent platform for the buyers and sellers to carry out procurement activities in a fair and competitive manner.

- In FY23, the procurement of goods and services from the government portal crossed the Rs. 2 lakh crore (US$ 24 billion) mark.

- As of November 2022, the GeM portal has served 12.28 million orders worth Rs. 3,34,933 crore (US$ 40.97 billion) from 5.44 million registered sellers and service providers for 62,247 buyer organizations.

- In a bid to systematise the onboarding process of retailers on e-commerce platforms, the Department for Promotion of Industry, and Internal Trade (DPIIT) is reportedly planning to use the Open Network for Digital Commerce (ONDC) to set protocols for cataloguing, vendor discovery and price discovery. The department aims to provide equal opportunities to all marketplace players to make optimum use of the e-commerce ecosystem in the larger interest of the country and its citizens.

- National Retail Policy: The government had identified five areas in its proposed national retail policy—ease of doing business, rationalisation of the licence process, digitisation of retail, focus on reforms and an open network for digital commerce—stating that offline retail and e-commerce need to be administered in an integral manner.

- The Consumer Protection (e-commerce) Rules 2020 notified by the Consumer Affairs Ministry in July directed e-commerce companies to display the country of origin alongside the product listings. In addition, the companies will also have to reveal parameters that go behind determining product listings on their platforms.

- Government e-Marketplace (GeM) signed a Memorandum of Understanding (MoU) with Union Bank of India to facilitate a cashless, paperless, and transparent payment system for an array of services in October 2019.

- Under the Digital India movement, the Government launched various initiatives like Umang, Start-up India Portal, Bharat Interface for Money (BHIM) etc. to boost digitisation.

- In October 2020, Minister of Commerce, and Industry, Mr. Piyush Goyal invited start-ups to register at the public procurement portal, GeM, and offer goods and services to government organisations and PSUs.

- In October 2020, amending the equalisation levy rules of 2016, the government mandated foreign companies operating e-commerce platforms in India to have permanent account numbers (PAN). It imposed a 2% tax in the FY21 budget on the sale of goods or delivery of services through a non-resident e-commerce operator.

- In order to increase the participation of foreign players in E-commerce, the Indian Government hiked the limit of FDI in the E-commerce marketplace model to up to 100% (in B2B models).

- Heavy investment made by the Government in rolling out a fibre network for 5G will help boost E-commerce in India.

Road Ahead

The E-commerce industry has been directly impacting micro, small & medium enterprises (MSME) in India by providing means of financing, technology and training and has a favourable cascading effect on other industries as well. The Indian E-commerce industry has been on an upward growth trajectory and is expected to surpass the US to become the second-largest E-commerce market in the world by 2034. Technology-enabled innovations like digital payments, hyper-local logistics, analytics-driven customer engagement and digital advertisements will likely support the growth in the sector. India is also planning to introduce an Open Network for Digital Commerce (ONDC).

ONDC will enable e-commerce platforms to synchronize search results on all the e-commerce platforms and display products and services from every platform. This will further boost business for MSMEs and help fuel India’s e-commerce growth. The growth in the sector will further encourage employment, increase revenues from exports, increase tax collection by exchequers, and provide better products and services to customers in the long term.

India has gained 125 million online shoppers in the past three years, with another 80 million expected to join by 2025, according to a report by Kantar.

The Indian e-commerce sector is likely to expand in different markets. India’s e-retail market is expected to continue its strong growth - it registered a CAGR of over 35% to reach Rs. 1.8 lakh crore (US$ 25.75 billion) in FY20. Over the next five years, the Indian e-retail industry is projected to exceed ~300-350 million shoppers, propelling the online Gross Merchandise Value (GMV) to US$ 100-120 billion by 2025.

According to Bain & Company report, India’s social commerce gross merchandise value (GMV) stood at ~US$ 2 billion in 2020. By 2025, it is expected to reach US$ 20 billion, with a potentially monumental jump to US$ 70 billion by 2030, owing to high mobile usage.

References: Media Reports, Press releases, Business Standard, Economic Times, LiveMint, Times Now, Times of India

![]()

![]()

![]()

![]()